Starting from September 1, 2023, certain rules from Bill 25 will become effective in Quebec to combat illegal tourist accommodations. This legislative push aims to establish a stricter framework for lodging operations and threatens hefty fines of up to $100,000 for violations. There’s a growing chorus of voices advocating for other Canadian provinces to follow Quebec’s lead in imposing stricter regulations on short-term rentals, including giants like Airbnb. British Columbia is already on the path to adopting a similar regulatory stance. What this increased regulatory scrutiny means for investors is that they might want to explore alternative short-term rental markets with great potential.

Punta Cana, in the Dominican Republic, shines as one such market, renowned for its continuously booming tourism sector, cementing its status as one of the Caribbean’s top tourist hotspots. As a result, investing in rental properties in this city holds significant promise for generating income and building long-term wealth, drawing interest from Canadians, Americans, and European retirees alike.

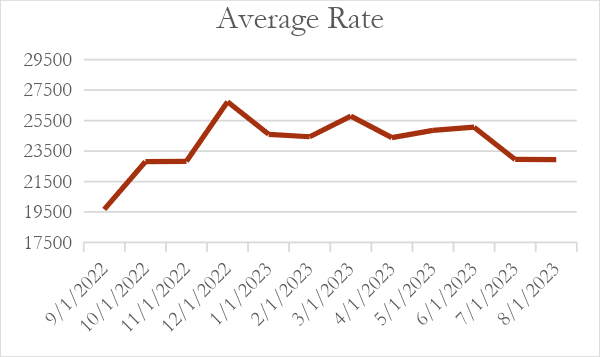

The wealth of data paints a comprehensive picture of the short-term rental market in Punta Cana. This market is characterized by remarkable growth, with an average annual revenue per property reaching approximately $75,000 USD, showing a substantial 56% year-over-year increase. The average daily rate of $25,200 DOP (about $450 USD) has also seen a healthy 35% annual increase.

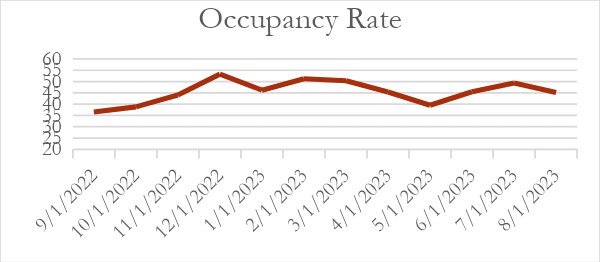

A noteworthy aspect is the increasing occupancy rate, which has risen by 10% year-over-year to reach 46%. It’s worth emphasizing that this figure doesn’t include alternative rental channels such as direct bookings, cash transactions, or bookings through other platforms, implying that the actual occupancy rate is likely higher.

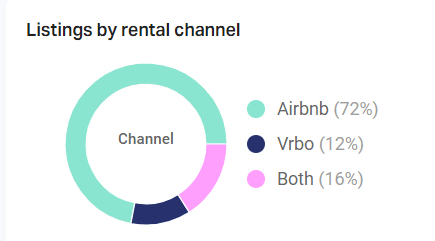

The market continues to expand, with a 24% year-over-year increase in total available listings, totaling 5,920 properties. Airbnb remains the dominant player with a 72% share, followed by Vrbo at 12%, and a 16% utilizing both platforms.

A fascinating trend is the annual availability of these properties, indicating that many owners use their own units for extended periods (usually this would be during the high season). With 42% available for 1-3 months, 26% for 3-6 months, 18% for 6-9 months, and just 15% for 9-12 months, this data underscores the variety of owners’ usage patterns.

Notably, the lowest occupancy occurs in September, while December records the highest, revealing clear seasonality. The lead time for bookings has also decreased, down by 26% to an average of 44 days, although bookings for December are made far in advance, with an average lead time of 68 days. Lastly, guests tend to stay for an average of four days.

Overall, this data paints an optimistic outlook for the short-term rental market in Punta Cana, with promising growth potential and strong demand, particularly during the high season.

North America’s Real Estate Marketing Dynamics

Like Canada, even the United States is experiencing a surging demand for homes, yet the supply falls short, driving a relentless climb in home prices. The period from 2020 to 2021 witnessed an 18% surge in new home prices, followed by a 15% uptick from 2021 to 2022. By 2022, the average home price reached a historic high of $348,079. Similarly, Canada is grappling with escalating home prices driven by high demand outstripping available supply. Data from the Canadian Real Estate Association (CREA) in May 2023 reveals that the average property price in Canada jumped by 4.3% in April and has risen roughly 17% since January. The price spectrum spans from $324,600 in St. John’s to $1,017,979 in British Columbia.

Escalating real estate costs in the United States, Canada, and Europe stem from stringent building regulations and high taxes. These factors, along with COVID-19 lockdowns, labor shortages, and supply chain disruptions, have further constricted housing supply. The U.S. housing market faces challenging economic conditions, including:

1. Soaring home prices

2. Scarce supply of existing homes for sale

3. High occupancy rates

4. Increasing rents

Additionally, 30-year mortgage interest rates have doubled, reaching an all-time high of 5.66% in a bid to combat inflation and lackluster demand despite slow economic growth. Consequently, homebuyers and investors confront a conundrum regarding their next steps in the market.

High property taxes exhibit significant variation across U.S. states, from Hawaii’s 0.28% to Connecticut’s 2.14%, impacting most homeowners. Similarly, in Canada, property taxes can be high, reaching 1.72% in Sault Ste. Marie and 2.64% in Winnipeg. Meanwhile, a growing retirement population in the U.S. and Canada, with 10,000 daily retirees and projections of over 88 million retirees by 2050, raises concerns about social isolation and limited affordable housing. Some retirees seek countries with friendlier regulations, lower taxes, and reduced living costs. Lastly, the real estate sales process in the U.S. and Canada suffers inefficiencies, as many sellers and agents lack a deep understanding of their target markets, leading to prolonged and frustrating property transactions, hindering overall efficiency.

For People like you, Realtor DR is dedicated to providing access to affordable properties in Punta Cana, including homes, condos, and land, with options starting at $100,000, significantly more affordable than the US and Canadian markets. Abundant land supply in Punta Cana, allowing year-round construction due to the warm climate, results in lower construction costs, and subsequently, lower property prices. Moreover, the region offers tax relief, with property owners enjoying exemptions, including a three-year property tax exemption for those with Dominican residency acquired through the investment program. Those who invest in Confotur-certified buildings gain a 15-year tax immunity, covering property taxes, transfer taxes, and rental income, thanks to the Ministry of Tourism’s incentive program. Punta Cana is also an ideal retirement destination for US and Canadian nationals due to its low cost of living, safety, favorable tax environment, healthcare facilities, schools, and abundant amenities.

For Real Estate Developers and Brokers, Realtor DR goes the extra mile by providing an exclusive “Investor Summary” for each property listing. This invaluable tool offers in-depth insights into property costs and potential income based on historical data, giving you a comprehensive understanding of the investment potential. Our commitment to efficiency remains unwavering, ensuring a seamless transaction experience from listing to accessing critical financial information for informed decision-making.